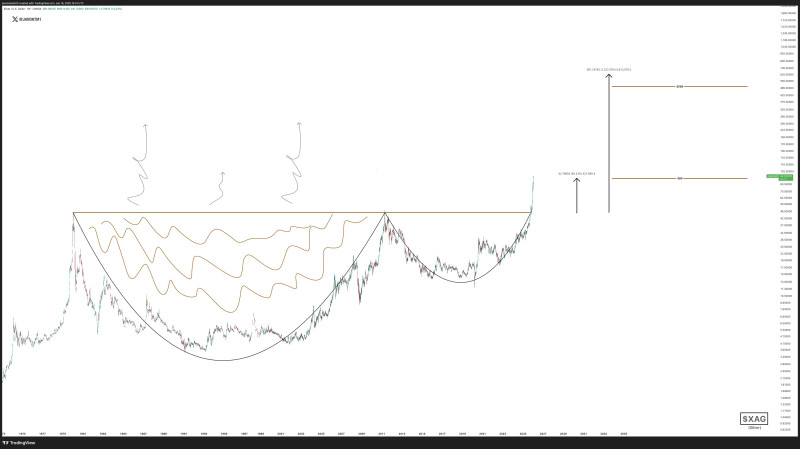

⬤ Silver finally broke free from a price pattern that's been building for literal decades, shooting up from around $55.50 to hit the $90 mark—a clean 62% gain that's got the metals market buzzing. The breakout wasn't some quick pop and drop either; this move came after silver spent years coiling up energy in a massive base formation that shows up clear as day on long-term charts.

⬤ Look at the bigger picture and you'll see silver carved out this huge rounded bottom over multiple decades, constantly bumping its head against the same resistance ceiling. That lid kept silver trapped during previous rallies back in the late '70s and again in the early 2010s. But this time? Silver blasted through that old barrier and kept climbing instead of falling back down, proving this breakout was the real deal.

⬤ Once silver cleared that resistance zone, it didn't mess around—the price shot straight up to the $90 non-logarithmic target that technicians had mapped out. "The magnitude of the move reflects the scale of the preceding consolidation and underscores the importance of the breakout," showing just how much pent-up energy was sitting in that multi-decade base. While there are higher reference levels projected on the charts, hitting this primary target is the big achievement here.

⬤ This matters way beyond just silver traders making money. Silver plays double duty as both an industrial metal and a store of value, so when it breaks out of decades-long patterns, it sends ripples through the entire precious metals complex. These kinds of massive consolidation breakouts often kick off sustained trends that reshape market expectations and volatility across commodities—and silver just gave us a textbook example of what happens when all that pressure finally releases.