According to Masterforex-V Academy, the Chinese Yuan has become one of the 5 most popular currencies worldwide. This is the first time, the Renminbi has ousted the Australian Dollar and the Canadian Dollar. In December 2014, the Chinese currencies was used in 2,17% of international transactions. This is confirmed by the SWIFT figures.

It appears that the Chinese Yuan comes next to the Japanese Yen (right after it to be exact). The Japanese currency was used in 2,69% of international transactions in December 2014. The TOP 3 includes the U.S. Dollar, the common European currency and the British Pound.

At the same time, the experts of Masterforex-V Academy report that the popularity of the Chinese Yuan mother than doubled up over the course o 2014. If to compare the latest figures to those seen in December 2012, this is 350%!

It seems like the Beijing’s efforts to make the Renminbi a global currency have been successful so far. Yet this is not the end as the Chinese government is definitely going to keep on making efforts to expand its presence in the global financial environment. These efforts include multiple currency swaps signed with the central banks of many countries, including Russia these swaps are designed to avoid the U.S. Dollar in the bilateral trade relations between China and its trade partners.

It should be noted that the IMF may well reconsider some points, which may ultimately result in making the Renminbi an official global reserve currency along with the U.S. Dollar and the Euro.

More and more experts worldwide predict a bright future to the Chinese Yuan. HSBC is one of such predictors. In early 2014, the experts predicted that in 12 months the rRenminbi was going to enter the TOP3. As we can see, the prediction happens to be close to coming true. They also predicted that in a couple of years the Chinese Yuan may become a 100% free floating currency, with up to 30% of of the global transactions being made in CNY in 5 years.

The Yuan is definitely making its way up to the top. 4 years ago, tit used to account for just 3% of China’s external trade. For now, the percent has sextupled up to 18%.

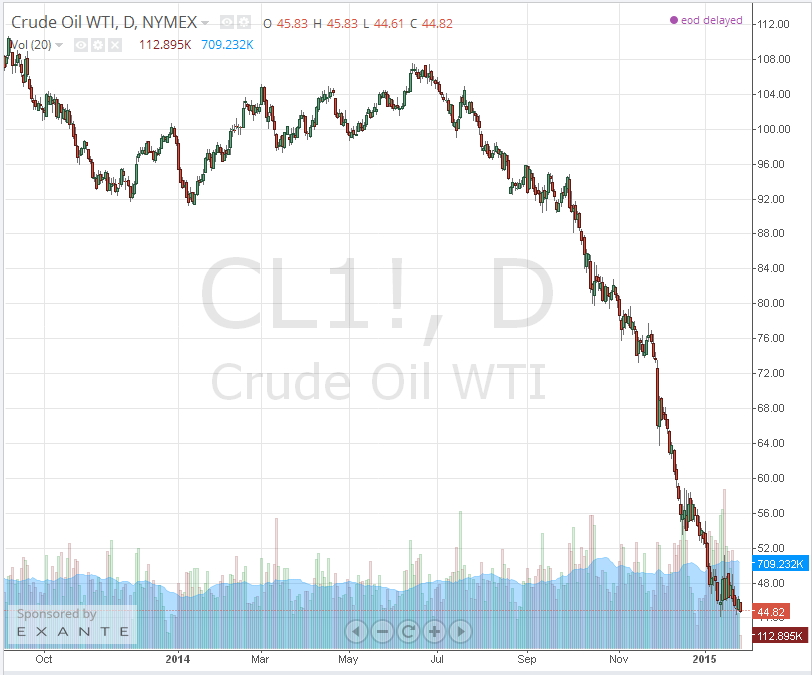

At the same time, China is influencing oil prices along with the OPEC. While the OPEC doesn’t want to cut down on its production, thereby keeping the supply stable, China seems to be cutting down on its demand for oil mind the economic slowdown caused by lower global consumption. When combined together, they keep on widening the excessive supply of oil in the global market, which further translate into declining oil prices.