According to Citigroup, a major US financial institution, if Mitt Romney wins the US presidential election, the Russian stock market may drop 9% down because Mr. Romney says Russia is the USA’s enemy #1. Russian experts respond that the chances of such a major decline are very low as there is a flight of capital anyway.

Mitt Romney Says Good Bye To “Reload Policy”

If Mitt Romney, the Republican candidate, wins the presidential elections in November, the reload policy towards Russia will come to an end because Russia is considered the USA’s major geopolitical enemy. Mr. Romney says it repeatedly. Russia often puts a veto on the resolutions offered by the USA in the UN. Russia is said to conduct such external policies that contradict the USA’s interests.

He says that the foreign investors account for 2/3 of the Russian stock market, with US funds accounting for 50% of this stake. Therefore, Citigroup experts assume that any major changes in the bilateral relations between the US and Russia will definitely affect the Russian stock market.

On the other hand, Russia’s defense industry will only benefit from Mitt Romney’s victory. Anyway, Barack Obama’s reelection is still considered as the most probable scenario.

As of August 29th 2012, the MICEZ index dropped by 1% while the RTS index lost 1.3% of its value.

According to RoboForex, technically, a 9% decline is a probable scenario for the Russian stock market. However, the market keeps seeing a flight of capital. Therefore, this factor is unlikely to affect Russian stocks seriously if Mitt Romney does win the elections.

FX Clearing feels skeptical towards Citigroup’s forecasts there are too many factors affecting the Russian stock market. Therefore, a single factor cannot have a major impact.

Forex.

Meanwhile, EURUSD managed to rally up to 1.2542.

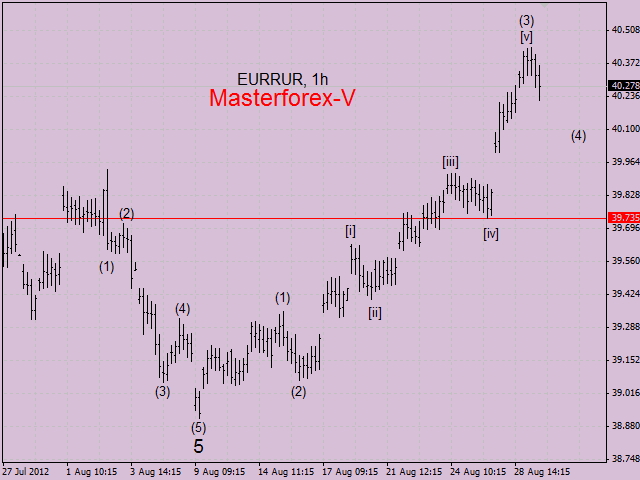

The chart below, courtesy of , reflects the current state of affairs in the market of EURRUR (the Euro versus the Russian Ruble):