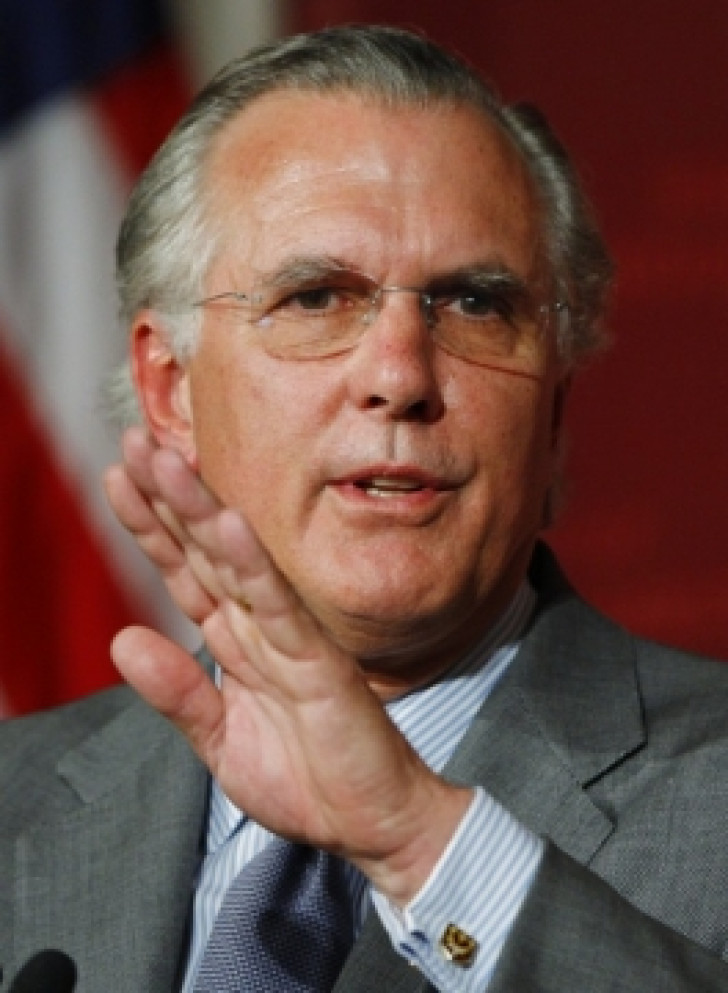

Forex news, dollar rate. According to the president of Federal Reserve Bank of Dallas Richard Fisher, it is not the time make monetary policy harder, despite the fact that US FRS has provided the country’s economy with too many stimuli.

Besides, Richard Fisher has stated that he is against Federal Reserve System obligations about current interest rate and said that he would like monetary policy to be more clearly defined by economic development, but not calendar dates.

According to Fisher, FRS has come close to the point when too much information about its work will be provided to investors, which is connected with the start of publications of Fedreserve economic predictions. The president of Dallas FRB has warned that these predictions are to be assessed very carefully because of unreliable long-term predictions in current economic situation.

As stated by Fisher, the country’s current economic situation is characterized as mixed, without sufficient growth of new jobs.

Speaking about inflation forecasts, the president of Dallas FRB has admitted that it is returning to the target point of 2%, and high prices for fuel are having smaller impact on US economy than expected.

Today leading European countries are having a holiday, and strong trends are not to be expected. However, let us consider possible flow of events.

Experts of have explained short-term situation with EUR/USD:

MSF 1.3266 – 1.3207 А/В Н1.

On this basis, there are the following variants:

- up wave с(С) Н4, consequently its sub-wave А, first breaking of С, second, movement to short-term targets;

- down wave а(С) Н1, first breaking of с(С), second movement to correctional targets, possible breaking of NK Н8 and pivot, end of bullish wave from ТО 1.3104;

- flat movement as a part of MSF.

Dollar Rate: President of Dallas FRB Commented on FRS Policy