According to the experts working for Goldman Sachs, one of the largest investment banks in the world, the U.S. Federal Reserve is probably going to raise the key interest rate 4 times next year.

In particular, the experts assume that the American economy is nearing 2018 with fairly strong stats. This economic strengthening is expected to push earnings and inflation higher. Naturally, the Fed is likely going to respond with tougher money-and-credit policies, including interest rate hikes. The U.S. unemployment rate is expected to shrink down to 3,7% and 3,5% by the end of 2018 and 2019 respectively. If that’s the case, this will be the lowest unemployment rate in more than 50 years. By the way, the current unemployment rate is at 4,1%.

Still, some experts believe Goldman Sachs’ forecast is way too optimistic. They appeal to macroeconomic stats when reasoning their standpoint. In particular, they say that the figures only seem really strong while the real state of affairs is not that clear.

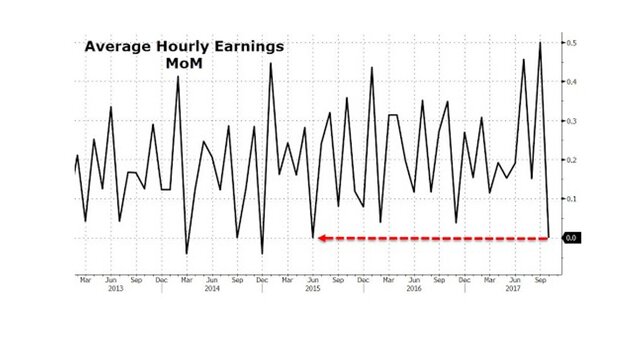

For example, let’s take a look at the U.S. labor market. American businesses created 261K new jobs in October, but 89K of them belong to waiters and bartenders. Hourly earnings almost stopped growing – only 2,4% in 12 months.

For those of you who don't know, the Fed went back to raising interest rates in December 2015. They have raised the rates 4 times since then. Yet, another interest rate hike is expected in December. In 2012, the Fed introduced several goals – stable employment and inflation at 2%. Formally, this matches Goldman Sachs’ forecast for 2018 (1,8%).

Also, don’t forget about the staffing changes in the Federal Reserve. This is the moment when the Fed will probably have to revise their strategies and policies.