As you probably know by now, the latest OPEC summit, which took place more than a week ago, ended up with the OPEC members abstaining from cutting down on their oil production, there leaving it at 30 million barrels a day in total. Apparently, this has been one of the key drivers pushing oil prices down to new multi-year lows.

At the same time, more and more financial experts, including those representing the world’s biggest banks and other influential financial institution, assume that this is not the end as the price of crude oil is going to find its bottom somewhere below the current levels.

According to Oksana Kurennaya, a Russian economist, reports that Russia’s energy exports revenues make up to 46% of its budget, with oil exports counting for nearly 4/5 of the total export of energy carriers. With that said, the expert provides us with a gloomy forecast, thereby saying that the Russian economy may eventually collapse if the current weakness of the oil market continues in the near future.

She says that the Russian budget for 2015 is made with the expectations of $100/b. At this point, the Kremlin is considering Plan B, which implies an emergency budget based on $60/b. By saying so, the expert leads us to believe that Russia has only 2 alternative scenario under such circumstances - either to let the budget deficit grow or to cut the budget spending planned for the near future.

Ruble Goes Down

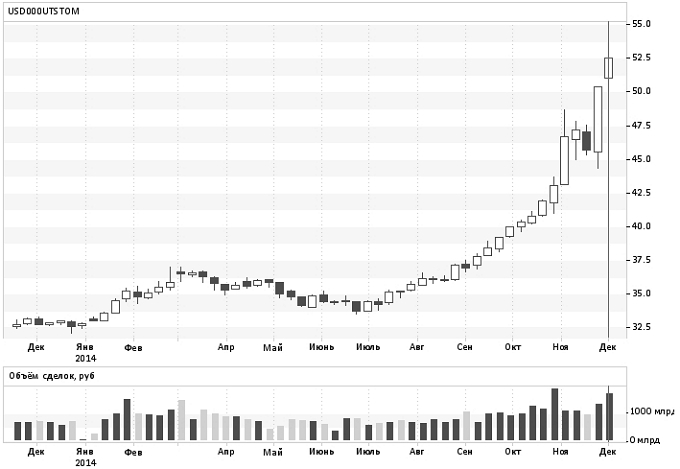

The actual exchange rate of the Russian Ruble versus a basket of currencies (consists of the currencies belonging to Russia’s major trade partners) dropped by 8,3% in November 2014. The Ruble lost 9,8% against the US Dollar and 8,4% against the common European currency.

As for a longer-term period such as January - November 2014, the Rubble lost 16,1% of its value against other currencies on average. In particular, it dropped by 23,4% against USD and 15,1% against EUR over the reporting period.

The record-breaking devaluation of the Russian Ruble seems to have triggered an inflation hike. At this point, most experts assume that the rate of inflation in Russia is going to hit 7,55% and 9,4% in 2014 and 2015 respectively. Apparently, these predictions are much higher than preliminary expectations.

At the same time, international experts predict an slowdown in the Russian economic growth, with negative performance expected in next year. In particular, the experts from Citi expect the Russian GDP to go -1 in 2015. ING assumes, the slowdown is going to reach 1,25%.

Meanwhile, more and more expert start revising their oil forecasts. Societe Generale downgraded its forecast for Brent by $20 down to $70/b for 2015. The similar forecast for WTI oil is own to $65.