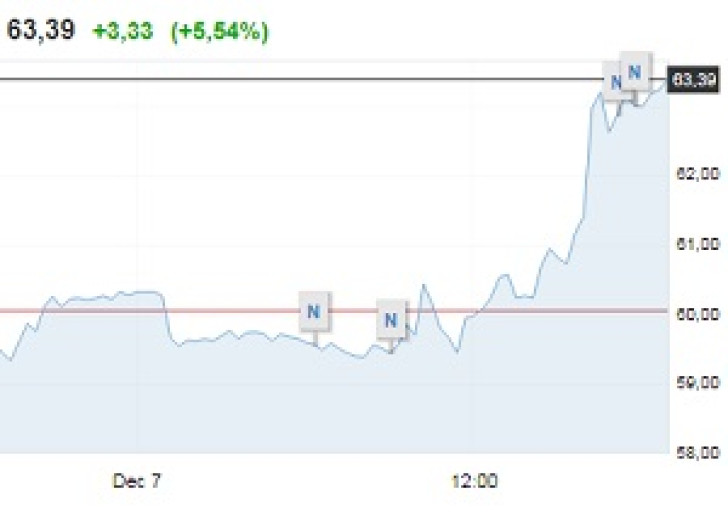

As you probably know, the participants of the latest OPEC summit agreed to cut down on their oil production next year. This triggered a temporary price rally in the international market of crude oil.

The second day of the summit turned out to be more successful than the first one. In particular, the first day ended with no agreement, mostly because of Russia and Iran. The next day, all of the participants managed to comprimise and sign an agreement.

For now, there are no details of the deal. However, some sources claim that the OPEC and their allies are planning tu cut their oil production by 1.2 million barrels a day. In particular, the OPEC is expected to cut it down by 800K b/d while the non-OPEC participants of the deal are expected to cut it down by 400K b/d. As for Russia, it is expected to make up for 50% of the non-OPEC production cut - 200K b/d. We remind you that Russia has failed to confirm its production cuts according to the previous agreement.

It's also interesting to note that Donald Trump is clearly going to be discontent with this situation. Previously, he insisted on the OPEC increasing their oil production to dump oil prices. According to him, expensive crude oil is like high taxes - it hinders the development of business. Even though the USA has now become an oil exporter, Americans still consume a lot f crude oil. That's why the USA would still prefer lower oil prices. On top fo that, the U.S. budget isn't dependent on the export of crude oil as much as the Russian one.

By the way, when Brent oil dropped below $60/b, Trump praised himself and asked Saudi Arabia to keep on going in the same direction. So, the latest OPEc decision is something he isn't going to like anyways.

Previously, it was reported that the OPEC can push Brent oil up to $65/b. Also, Qatar is reported to quit the OPEC in 2019.