International expert say that there is a really high probability of crude oil starting another rally to test $100/b. After a major drop down to $40/b that started in 2014, crude oil has been continuously trying to regain the lost ground. Since then, the price has doubled. At this point, Brent oil costs $85/b. Yet, this is not the limit, or at least it seems so right now.

Since the start of the year, the prices of Brent oil and WTI oil have gained 26% and 23% respectively. the market expects the prices to head for another major threshold in the near future, which is 100 dollars per barrel. What may be the reasons behind these brave expectations?

The thing is that, the international market of crude oil seems to be suffering from a deficit caused by some oil production issues in Venezuela and Libya, as well as a new round of sanctions imposed by the USA on Iran. However, it's interesting to note that the OPEC and Russia are capable to make up for this deficit. the thing is, they seem to be reluctant to do so.

Their standpoint is quite understandable since their budgets are heavily dependent on the income coming from their oil exports. Therefore, the higher the oil prices go, the more money they eventually gain when exporting their oil.

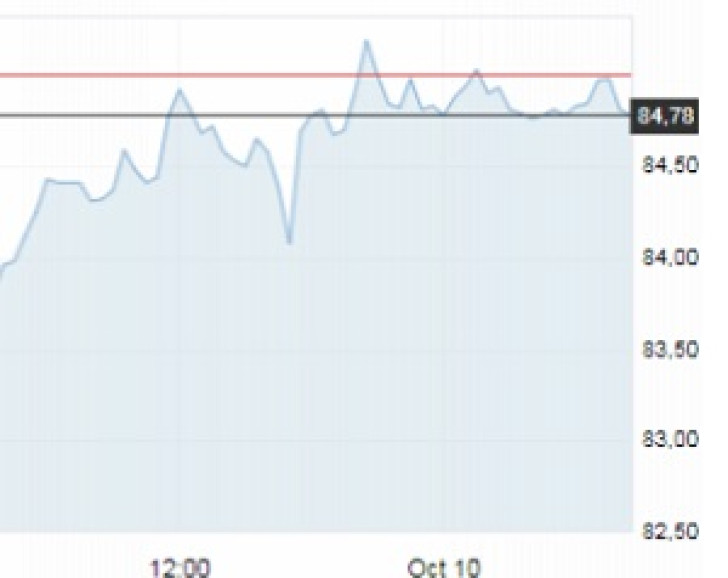

Still, yesterday, the market started the morning session thin the red zone. Brent oil traded at $84,78/b against $86,5/b seen a couple of days before. Still, there is nothing new about the ups and downs in the international market of crude oil. Such minor fluctuations happen on a daily basis. So, the key focus is the longer-term perspective. At this point, international experts anticipate another rally up to $100/b by the end of 2018. Everything will eventually depend on the Iranian export of crude oil.