On the last day of November, the OPEC and several non-OPEC oil exporters met in Vienna to discuss the future of the global oil market during the OPEC summit. The summit ended with extending the OPEC+ deal until the end of 2018. Experts say this decision means the OPEC+ participants have lost the long-term oil war with American shale oil companies.

Most of the 20 countries participating in the OPEC+ deal can barely make both ends meet. Now they have to keep on capping their oil production while crude oil makes up for the lion’s share of their national budgets. For those of you who don’t know, the OPEC+ deal has been active for 11 months already. So far, the deal hasn’t still reached the goal – to eliminate the excessive oil inventories worldwide and restore the oil market balance. At first, the participants thought they could make it in 6 months or so. Later on, they decided to extend the OPEC+ deal for 9 more months until March 2018. However, now they understand that they won’t make it by March 2018, and that’s why they decided to extend the deal for the rest of the year during the recent summit.

Today’s commercial oil inventories are well above the 5-year average by 150 million barrels, and the demand for crude oil in winter is going to decrease. That’s why there won’t be any improvement by March 2018, and the OPEC is perfectly aware of that. Even the most optimistic prediction say that they won’t be able to balance the market until Q3 2018. And even if they make it, the oil production growth will be gradual, and in 2019 it will still be below the level seen in October 2016 – right in advance of the OPEC+ deal.

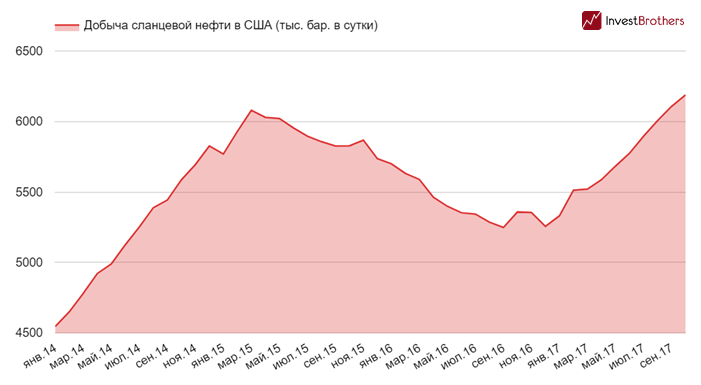

The OPEC+ deal participants say this is a big victory. However, Blackwell Global Investments analyst Steven Knight thinks this is a defeat, and the real winners are American shale oil companies. The shale oil production in the United States has doubled since early 2017 – from 1 million b/d to 2 million b/d.

The OPEC+ deal is a true gift for American shale oil companies since as long as oil prices stay above $50/b, they are definitely going to expand their production up until 2020, Per Magnus from Rystad Energy assumes. They will be able to satisfy the new demand for crude oil in 2018 almost entirely. The IEA expects it to by around 1,3 million b/d.

By 2025, American shale oil companies are expected to be producing almost 17 million barrels a day. At least, this is what is stated in the IEA’s World Energy Outlook 2017. This means that there is almost no space left for OPEC producers. The thing is that the OPEC will only be able to increase their production by 200K b/d (0,5%). Bank of America experts think that both the OPEC and Russia will have to put up with $40/b if they want to resist the American shale oil expansion. However, 60% of their foreign currency earnings comes from oil exports, which is why this resistance won’t probably last long anyway.

That’s a vicious circle for the OPEC. In order to beat American rivals, they keep on capping their oil production. As they push oil prices higher, this becomes favorable for the Americans. So, the OPEC keeps on yielding their market share to American shale oil companies. On the other hand, if they abandon the OPEC+ deal and increase their production, the market will crash in an instance. That’s why American shale oil companies are likely to win this game.