Moscow is against cutting their oil production any further if there is such an offer further down the road. They know that if they have to meet with OPEC members anytime in the near future, and given the fact that the recent extension of the Vienna Accord seems to be failing to do what it’s meant to do, such an offer may really be the case. By the way, Bloomberg reports that another Russia-OPEC meeting is scheduled for July 24, 2017 in Saint Petersburg, Russia.

According to some Russian representatives interviewed by Bloomberg, even the very process of discussing the possibility of further production cuts my set the markets a negative signal by giving them to understand that both Russia and the OPEC believe that the extended agreement is not enough to achieve the desired results in the near future.

For now, the Russian Ministry of Energy has refused to comment on the situation. The only thing they said was about reiterating their commitment to stick to the extended agreement until it expires in March 2018.

By the way, those interviewed by Bloomberg believe that despite the speculative decline of oil prices, the global oil market has been restoring the balance ever since the agreement was extended in May, which is confirmed by the fact that the amount of functioning oil rigs around the world keeps on going down, and so do the global oil inventories.

This is something that Russian Energy Minister Alexander Novak told previously. He assumes that the market still has upward potential in the second half of the year. He also assures us that Russia cut their oil production more than agreed with the OPEC – by 306-308K barrels a day in June.

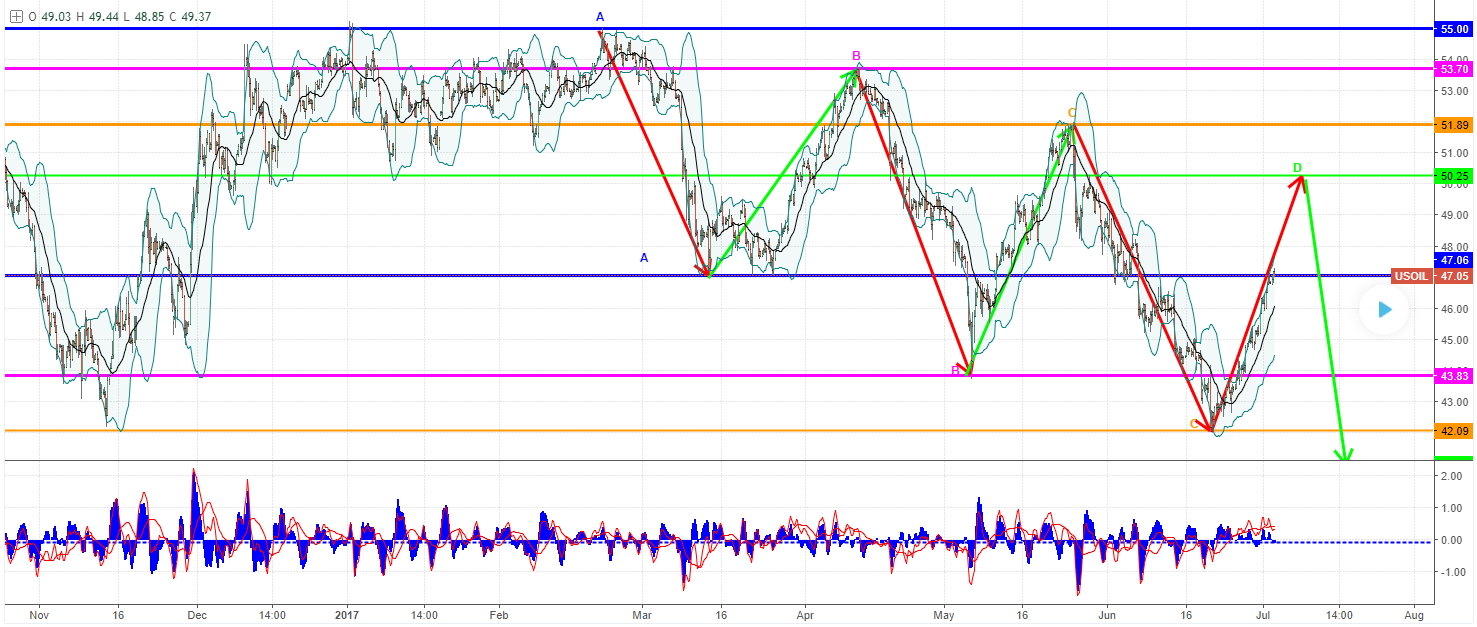

By the way, Market Leader previously reported that the OPEC had actually increased their oil production all the way up to the highest level seen this year. Today, the market reacted to the news by accelerating the downtrend. In particular, the Brent oil futures for September delivery depreciated by 0,97% down to $49,12 per barrel. At the same time, the WTI oil futures for August delivery depreciated by 1,25% down to $46,49 per barrel. NordFX analysts say that the whole market environment is getting worse of oil prices and the overall bias is turning more and more bearish, especially given the latest news coming from the OPEC.