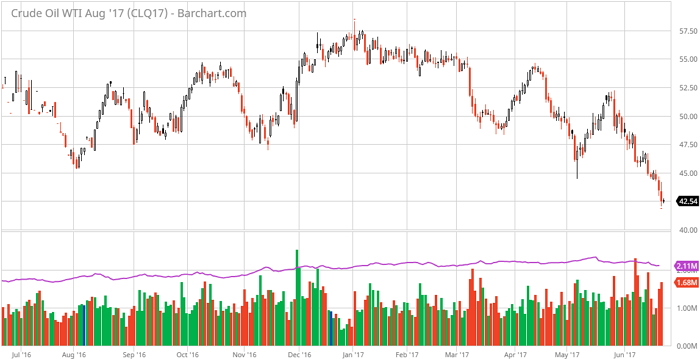

Oil prices keep on going down. Yesterday, for the first time since November 2016, the price of Brent oil dropped below $45/b. to be more specific, later on the trading day, a barrel of Brent oil cost $44,63 in London (ICE Futures). This means that the price dropped by 3% over the trading day. A day before, the trading session ended up with $46,02/b, NordFX reports. This is the lowest price since November 15, 2016.

At the same time, some experts say that this is a temporary drop in oil prices. The latest bearish moves are said to have been of speculative nature. That’s why they expect a sharp increase in oil prices in the near future. Those who support the idea of higher oil prices in the near future back this prediction by the fact that the OPEC reserves have been cut, which will naturally cause higher oil prices further down the road, even despite the current downward pressure of purely speculative nature.

However, some other experts don’t share this standpoint and say that the current downtrend and a move down below $45/b is a natural outcome rather than a speculator-driven event. In particular, they say that on top of some non-OPEC members, even several OPEC members (Libya and Nigeria) have actually boosted their oil production over the last 2 months. At the same time, the amount of oil rigs functioning in the United States has increased as well, amid growing oil inventories. Moreover, despite the extended Vienna Accord, the global export of crude oil has seen zero change recently, which doesn’t contribute to cutting the oversupply. Amid all of that, they don’t deny a further drop down to $40/b in the near future.