According to Vladimir Milov, President of the Russian Institute of Energy Politics, OPEC members and their partners have failed to trigger higher oil prices by cutting their daily oil production. At the same time, he believes that the cartel is not ready to implement further production cuts.

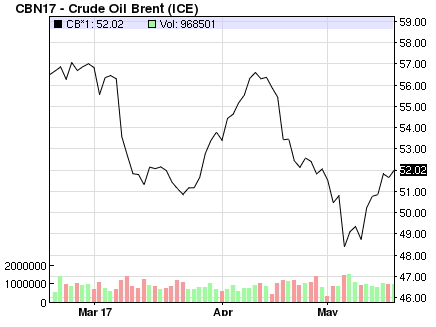

In his article published in RBK, he underlines the fact that the news about Russia and Saudi Arabia agreeing to extend the Vienna Accord has pushed oil prices slightly higher. However, he points out the fact that the expectations of the agreement extension have already been taken into account by the market. Nobody doubts that they will extend the agreement until March 2018 during the forthcoming OPEC summit scheduled for May 25.

For now, the expert says that the cartel and their non-OPEC allies did manage to cut the oversupply in the global market of crude oil as opposed to the one seen in late 2016. So, now we may talk about certain stabilization. At the same time, the world’s major oil importers are seeing their oil inventories reach around record-high levels. Moreover, the price rally allowed American shale companies to resume their oil production to make up for the production cuts coming from the participants of the Vienna Accord.

The IEA expects the daily production in the USA to boost by as much as 500K barrels a day as opposed to the end of 2016. In Q4 2017, the production is expected to boost by as much as 800K against the production volume of Q4 2016. This is expected to happen amid the current slowdown in the global demand for crude oil triggered by record-high oil inventories seen in major oil-importing countries. To be more specific, the demand in 2017 is expected to grow just by 1,3 million barrels as opposed to 1,7 million barrels.

This leads us to believe that in order to reverse the tendency, it’s necessary to go beyond cutting oil production by 1,7-1,8 million barrels a day according to the existing agreement. However, nobody is ready to take one step further in this direction, maybe except Saudi Arabia. In 6 months, they have failed to reach the desired outcome in the form of significant price growth. At this point, oil prices are slightly higher than those seen in November 2016 when the Vienna Accord was signed. That’s why many of those participants are discontent with the agreement and keep on suffering financial losses.

What did they really want?

The question is, did those oil exporters really believed in the possibility of breaking the tendency or did they just want to clean the market and oust a little bit of excessive supply to raise prices just a little higher? Now, the latter looks more probable since the former would have required more urgent and serious steps. That’s why we should be surprised that some OPEC members have failed to stick to the agreement at all times. Even if you read those headlines saying about more-than-expected production cuts, in reality it’s all about Saudi Arabia. In fact, the Saudis have backed 50% of the OPEC’s production cuts to date while they account for only 30% of the OPEC’s total oil production.

At the same time, the UAE and Iraq don’t stick to the agreement to the full while they account for roughly 25% of the OPEC’s oil production combined. At the same time, Iran, Libya and Nigeria are not involved in cutting their oil production at all. That said, Saudi Arabia has been playing the key role in the Vienna Accord on the OPEC’s side. They already played a similar role in the 1980s while trying to suspend the downtrend and reverse oil prices. Back then, they failed to reach the goal. Most likely they learned a lesson back then and therefore they don’t want to make the same mistake again.