The difficulties with tax reforms in the USA and Saudi Arabia’s stance are expected to support commodity prices, some experts believe. As you know, oil prices have been going down for the last couple of weeks. They even reached the level that used to be prior to the so-called Vienna Accord.

To be more specific, at some point in the recent past, Brent futures plunged below 47 dollars per barrel, thereby making the Russian Ruble depreciate slightly against the U.S. Dollar and other major currencies as well. At that point, the Russian Ruble came close to 59 RUB per 1 USD, and the prospect of reaching the 60 threshold was very likely within the next couple of months.

As in 2016, now there are 2 major factors affecting the Russian Ruble – oil prices as well as the difference in interest rates between ruble and dollar bonds and deposits, EverFX experts say. As for the interest rate gap, it’s like to get tighter over time. The Russian central bank will definitely keep on cutting their rates while the Federal Reserve is expected to raise the rate at least 2 more times this year. If so, traders will gradually lose interest in investing in the Russian Ruble in favor of USD assets.

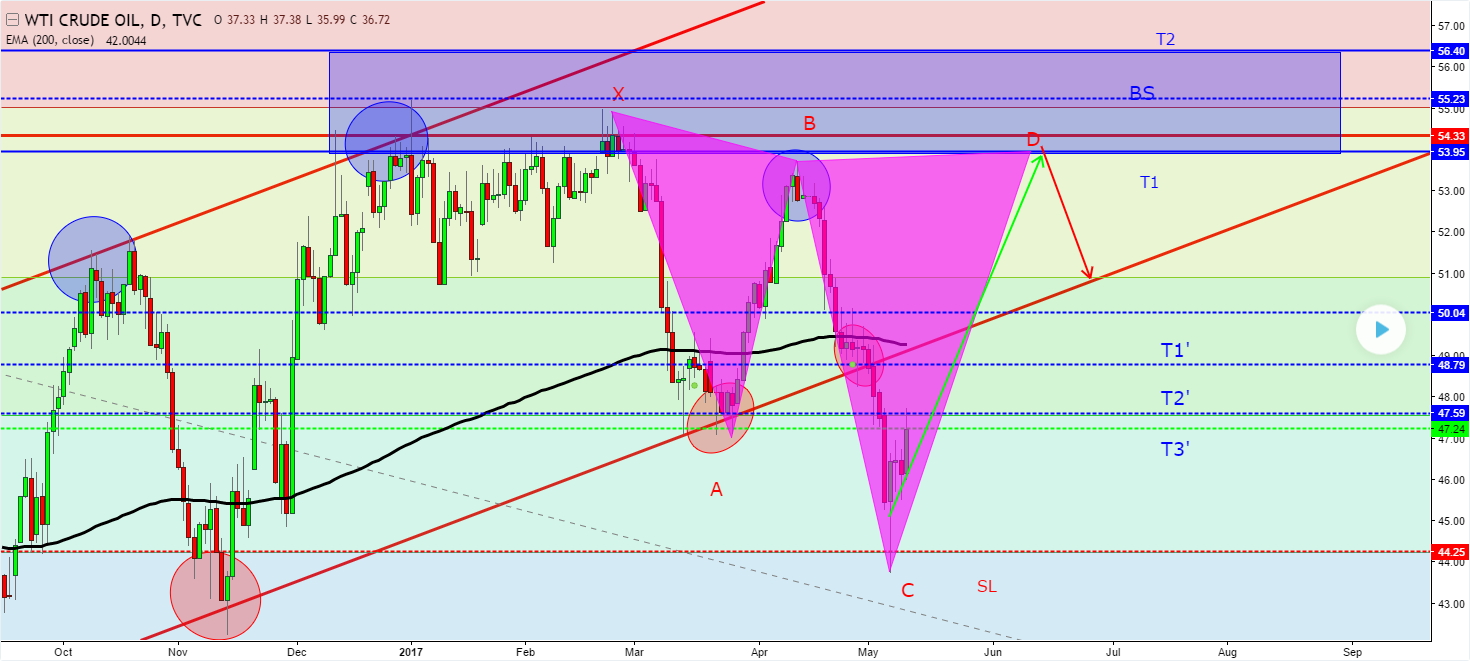

As for oil prices, experts don’t deny the likelihood of unexpected scenarios in the global market of crude oil. The price may either drop to 40 dollars per barrel and below, or skyrocket to 60 dollars per barrel and higher by the end of June 2017. All of that will mostly depend on the OPEC’s decision on extending the Vienna Accord during the forthcoming OPEC summit in Vienna on May 25, 2017.

Alex von Stachelkopf

Alex von Stachelkopf

Alex von Stachelkopf

Alex von Stachelkopf