Oil prices have been following a bearish trend over the last few days. International experts believe that if the OPEC doesn’t extend the so-called Vienna Accord, the prices are likely to drop below 40 dollars per barrel in a matter of weeks, if not days.

According to EverFX, the decision is going to be made during the forthcoming OPEC summit scheduled for the end of May. The OPEC is expected to extend the agreement to sustain oil prices above 50 dollars per barrel. Some experts even think that the cartel may cut their oil production even further down.

We remind you that the previous oil-production-cut agreement was signed by the OPEC and some non-OPEC members including Russia. The agreement seems to have failed to fulfil their expectations since the prices have dropped by more than 20% over the last few weeks. If the participants refuse to extend the agreement this time, the prices may dive deeper down, most likely below 40 barrels per barrel. This may well happen this June.

Still, the participants are rumored to have been staying positive on the idea of extending the agreement this time. The initial agreement was signed in November 2016 and took effect in January 2017. It implied cutting the OPEC’s total production by 1.2 million barrels a day as opposed to the production level of October 2016. The non-OPEC participants of the deal announced their production cuts by 600K barrels, with Russia being responsible for 300K of it.

Who do OPEC members say on possible agreement extension?

The production cut agreement expires on July 2017. Since oil prices have been going down over the last few weeks, international experts believe that the agreement is likely to extended. As mentioned, the final decision will be made during the forthcoming OPEC summit in Austria. The summit is scheduled for May 25, 2017.

The idea of extending the agreement is backed by the United Arab Emirates. They think that higher oil production in the USA doesn’t threaten the Vienna Accord. On top of that, the OPEC is expected to consider several scenarios regarding the Vienna Accord. The participants will vote for the best solution.

Another reason why the agreement has all chances to be extended is the fact that Saudi Arabia shares the UAE’s optimism and doesn’t mind extending the agreement as well. For those of you who don’t know, Saudi Arabia is the OPEC’s unofficial leader, which is why any idea supported by Saudi Arabia has more chances to be supported by other OPEC members. Kuwait and Brunei are also on the list of those who support the idea of extending the Vienna Accord at least for the restoof 2017.

As for Russia, their position is still unclear, though Russia seems to share the OPEC’s opinion that the global market needs rebalancing and is likely to back the agreement extension.

American shale oil companies affect the market.

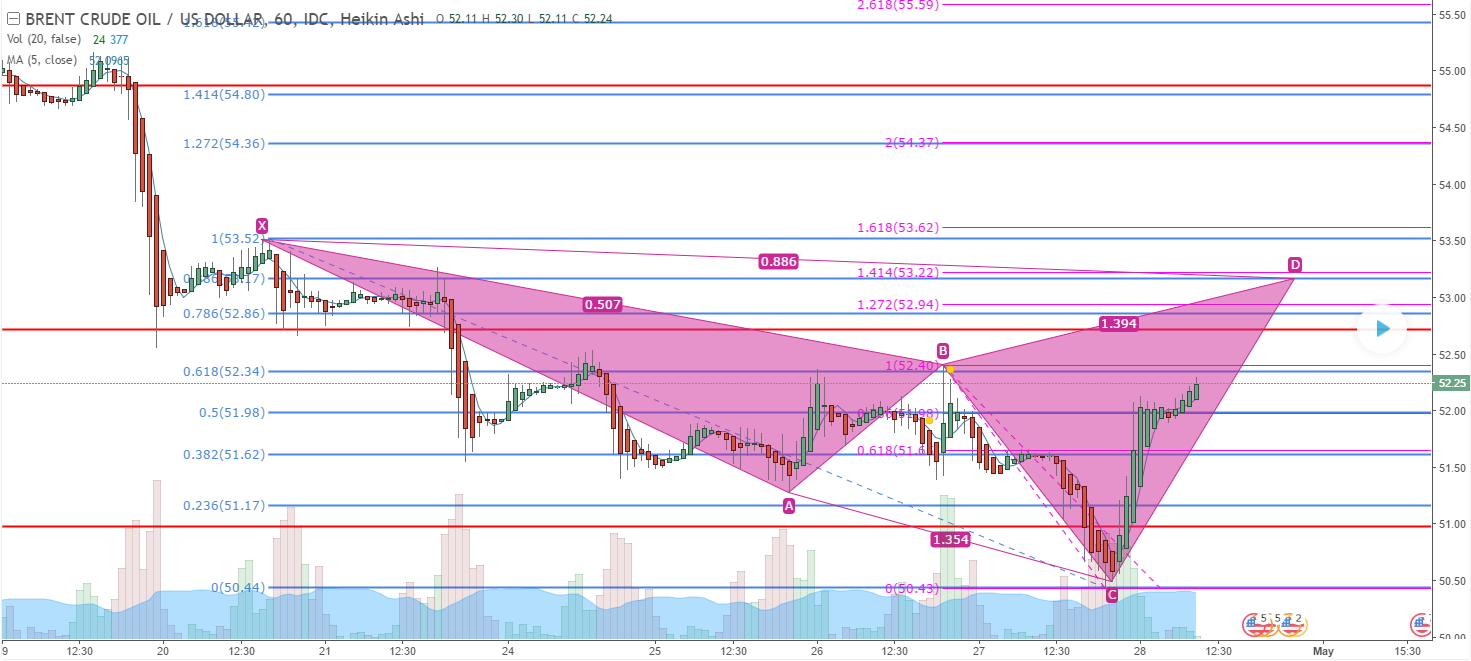

As of May 10, 2017, Brent oil stayed close to 50 dollars per barrel. Analysts say that the prices managed to regain a bit of the lost ground after the announcement that the key oil market players were going to cut their supplies to Asia. However, they don’t believe that the news will manage to bring prices back above the 50-dollar threshold to let them stay there and move higher to 55 and 60 dollars per barrel, especially amid the EIA’s predictions that America’s oil production may turn out to be higher – 9,3 million barrels a day instead of 9,2 million b/d. In 2018, it is expected to reach 10 million b/d. If that’s the case, that will extern downward pressure on oil prices. That’s why some other experts believe that the U.S. shale oil production is something that won’t let the OPEC and Russia succeed in backing higher oil prices by extending the Vienna Accord.