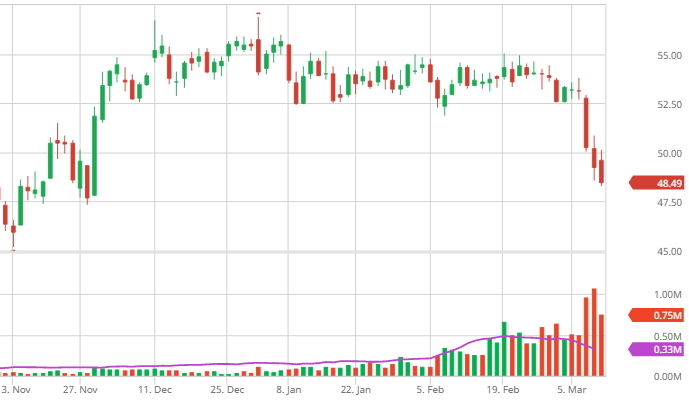

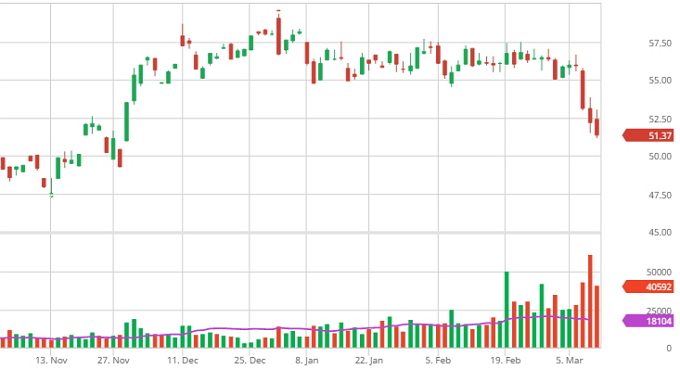

The cost of the WTI crude oil produced in the United States has dropped below the threshold of 50 dollars per barrel. This is reported to be the lowest price level since December 2016. Strange as it may seem, all of that happened despite the attempts made by the world’s leading oil producers to cut their oil production according to the so-called Vienna Accord aimed at restoring the market balance and push oil prices higher.

The mentioned price drop took place on March 9. Once again, the price is going down despite the join efforts of OPEC and some non-OPEC members to support crude oil prices and avoid any further weakening. All in all, the current tendency has been underway since March 8 when crude oil got 5% cheaper in a matter of hours. The next trading day, the price dropped 2% more. As for Brent oil, the situation is almost the same, apart from the fact it’s still trading above the $50/b threshold, but pretty close to it though.

At the same time, international experts report that the current tendency is caused mostly by higher oil production in the United States. As for the previous price hikes seen over the last couple of months, they were mostly caused by the mentioned joint efforts of the world’s biggest oil producers. But now the American shale oil industry seems to be reviving and making up for the production cuts seen overseas. The thing is, as the oil prices started recovering, at some point in the past shale oil production became profitable once again, which is why American shale oil companies has been restarting their idle capacities since then. All of that has been happening pretty fast given the relatively low costs. That’s why American oil inventories keep on growing and even seem to be bloated, which cannot but affect the global market of crude oil.

Under such circumstances, all eyes are now on Saudi Arabia and other major oil producers participating in the Vienna Accord. International experts say that at this point they have 2 options to choose from. The first one is all about sticking to the agreement as usual and continue cutting their oil production while yielding a certain share of the global market to American rivals. The second one means quitting the agreement for good and boosting their oil production again while sacrificing the profits by making oil prices drop again in favor of retaining their market share.

The problem is, the first option still doesn’t guarantee higher oil prices for the mentioned reasons associated with American shale oil. But at the same time, no one seems to believe those “shale interventions” anymore. Everyone seems to look at the actual figures, whether this is OPEC ore American shale oil production. At the same time, we should keep in mind the Iranian factor since Iran hasn’t still joined the agreement officially and keeps on pumping crude oil like never before.