Previous forecasts predicting market oversupply seem to need revision. According to the latest estimates, the oversupply in the global market of crude oil is not going to disappear at least until late 2017. The is what Bloomberg experts assume.

Previously, they had expected the imbalance to vanish in late 2016. However, this is obviously not going to happen for a number of reasons, which is why they are forced to change their mind. According to them, the global market of crude oil is still going to see excessive supply next year because of lower demand from China and India. The global demand is slowing down while the world’s major oil producers don’t seem to be cutting their production and export of crude oil.

This also leads us to believe that crude oil inventories all around the world are doomed to grow over time. This is going to be the 4th consecutive year of global oil overproduction. At the same time, in the 3rd quarter of the year, crude oil consumption is expected to slow down all the way down to the lowest point seen over the last 2 years.

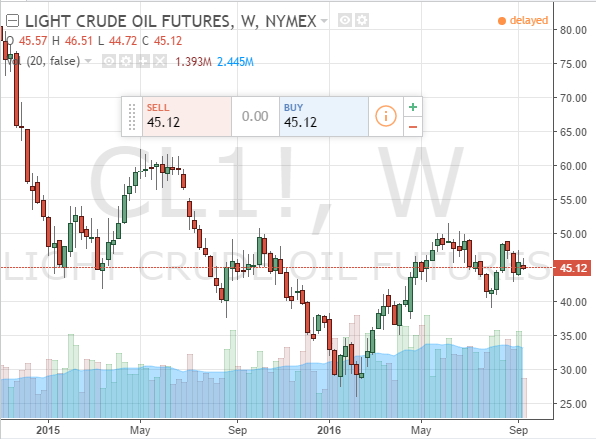

At the same time, most OPEC members don’t feel optimistic about the recent oil prices around $50/b. They obviously want much higher prices. Still, even these prices are constantly in jeopardy due to a number of seasonal factors and constant pressure caused by the overall market situation. That’s why OPEC members and other major oil producers, including Russia, are going to meet in Algeria in late September to discuss the situation and find the way out of the crisis they have been in for over 2 years to date.