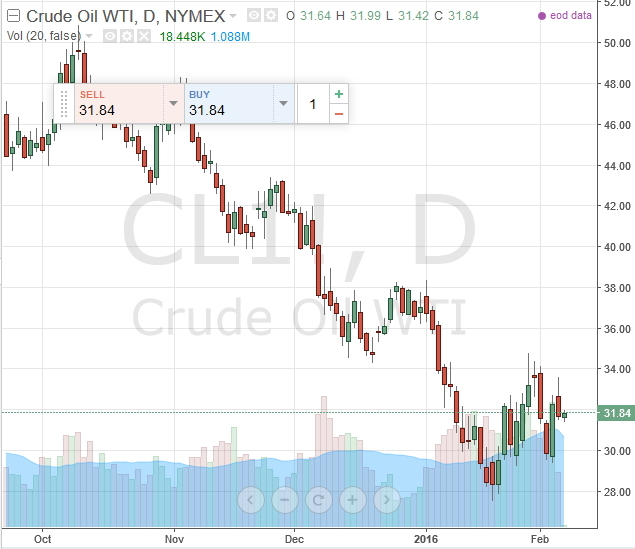

Morgan Stanley experts assume that despite the overall expectations of higher oil prices this year – the average price is expected to be somewhere in the range between 40 and 60 dollars per barrel – the price of crude oil is not actually going to advance much higher than $30/b. Moreover, the prices may even fall deeper down to new major lows.

Previously, Morgan Stanley used to expect the average price to improve all he way up to $59/b. This time, they predict a move in the opposite direction. The basic scenario is, Brent oil remain under $30-$31/b until this fall. In Q4 2016, it is expected to go down to $29/b. The first time the price is expected to above $30/b is spring 2017. The worst-case scenario implies a move down to $20/b in September-October 2016.

The key reason why Morgan Stanley turned bearish on crude oil is the existing imbalance in the global market of crude oil. The experts say that there are no chances to balance the market until early 2017, which leads us to believe that oil prices just cannot start recovering until this period in the future.

At the same time, Standard Chartered experts, which previously came up with the most negative prediction for the oil market - $10/b or lower – released a more optimistic forecast in late January 2016. This time, they say Brent oil may reach $70-$75 per barrel in late 2016! As for the mentioned price levels, Morgan Stanley expects the price to reach them no sooner than Q3 2018. It should also be noted that the experts expect the market of crude oil to go volatile this year while driven by currency exchange rates and breaking news and headlines.