According to the Saudi Arabian Minister of Oil, the global market of crude oil is going to start recovering at some point in the near future. As oil-exporting nations are said to be in tighter cooperation in their attempt to stabilize oil prices and make them reverse eventually, Saudi Arabia as the unofficial OPEC leader still insists on optimism regarding the future of crude oil.

He says that oil exporters are going to unite their efforts in order to prevent oil prices from crashing further down and to make them recover. However, the minister was reluctant to comment on the details of how they are going to implement this ambitious plan. He also refused to give comments on how Iran’s return to the global market is going to affect the overall situation (well, it is definitely not going to contribute to higher oil prices by any means since it only increases the oil supply).

Still, the minister hinted that Saudi Arabia and Mexico are going to play the key role in the process of restoring the global soil market.

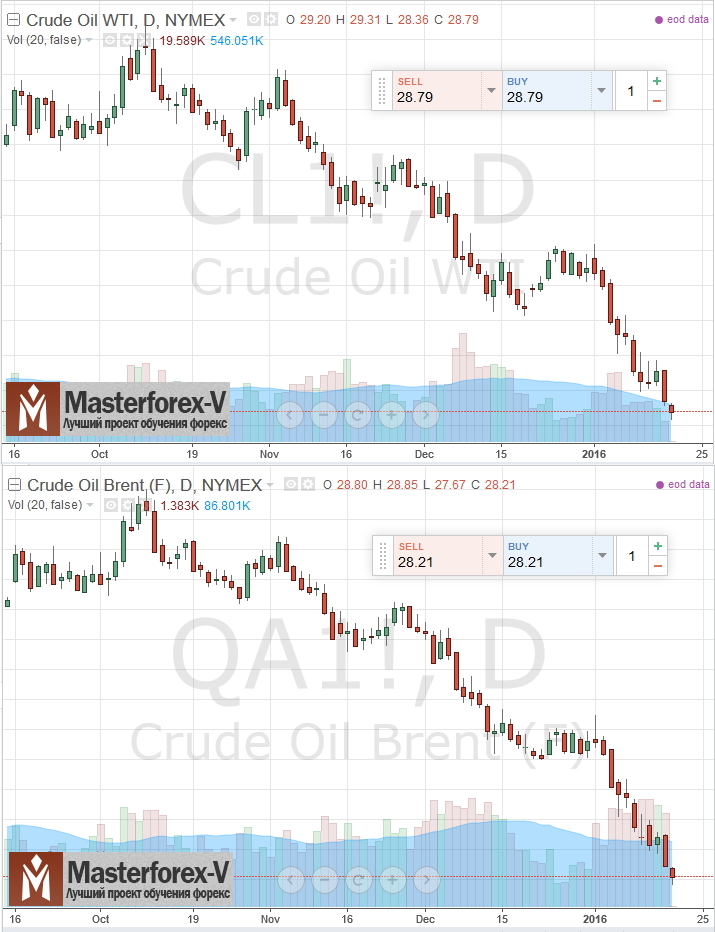

For those of you who don’t know, instantly after the European Union and the United States announced their decision to cancel the sanctions against Iran in exchange for its concessions regarding its nuclear program, Saudi Arabia’s business activity index crashed by 300 points. This is not accidental since Iran and Saudi Arabia have been regional rivals for decades. The competition is getting tougher now when Iran is going to return to the oil market with some 1 million barrels a day right off the bat, which is going to happen amid the declining ultra-low oil prices. This event is definitely going to press the prices even harder as Iran builds up on its oil production and export. Oil prices are already under $30/b. Last trading week ended up with prices above $29/b while today the prices have already plunged below $29/b, thereby reflecting the current state of affairs in the global market of crude oil.