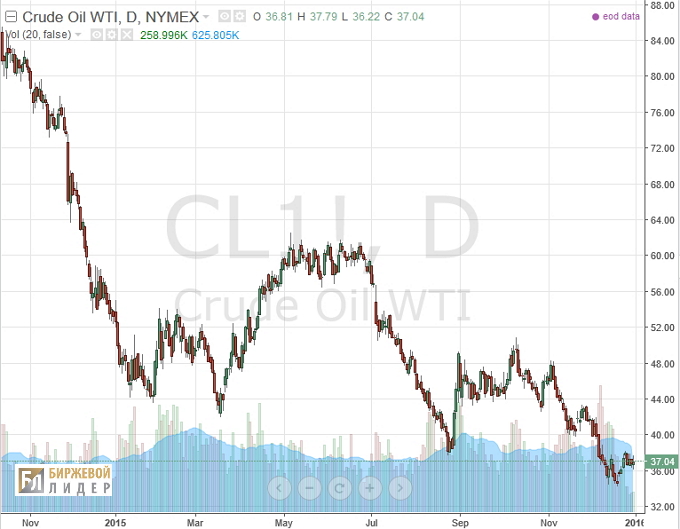

The increasing oversupply of crude oil coupled with decreasing demand keep triggered another oil market crash to new major lows. At this point, the prices have already set 11-yer lows. Yet, the downtrend may well continue.

It is interesting to note that over the last 40 years, there have been 4 major rallies in the market of crude oil – 1973, 1979, 1990 and 2008. All of those bull runs ended up with global economic recessions. If to consider these facts, low oil prices should do the opposite, i.e. stimulate the global economy since most of the nations around the globe are oil importers rather than exporters and should benefit from cheaper fuel and energy. Still, the reality has been showing the opposite ever since the beginning of the downtrend started from $115/b in August 2014.

Apparently, oil-exporting nations have already experienced the negative impact on their economies, trade and finances.

Analysts are at odds over the fate of the global oil market. They are also uncertain about whether the prolonged period of low oil prices is going to result in economic growth.

Some experts warn that consumer bubbles have already burst 3 time over the last 100 years. The first time it happened after World War I. The next time it was in the early 1980s. The third time is now!

Meanwhile, oil exporters are planning their budgets based on the oil prices they expect, which are far away from the current prices. Some experts say the price may go down to $25/b, and if that’s the case, we will see a major crisis coming.

Saudi Arabia is undoubtedly suffering from low oil prices. The local authorities are cutting spending to curb the growing deficit, which has already reached a critical level – 15 GDP% Many public projects are suspended and frozen for better times. Moreover, Saudi Arabia used to be financing their allies while it cannot afford it today. Moreover, the IMF warns that Saudi Arabia may go bankrupt within the next 5 years if the local authorities fail to introduced structural changes and major reforms to their economy.

Nigeria is still planning to stick to the spending plan despite less considerable income from oil exports, which makes 75% of the national GDP. This is very dangerous for the economy once it continues for a couple of years.

As for Russia, its economy is also heavily dependent on oil and gas exports – some 50% of the GDP. That is why the economic situation in the country is deteriorating while its national currency keeps on depreciating against the U.S. Dollar and other major currencies. For those of you who don’t know, an oil market crash was one of the reason why the USSR ceased to exist. Now, some experts say that the history is repeating itself and the same thing may happen with the Russian Federation if the situation in the oil market keeps on getting worse amid numerous Western sanctions. The 2016 budget is based on $50/b. And even if the price gets there, the Russian budget will still see a 3% deficit. If the situation doesn’t improve, Russian will have to cut the spending and spend the reserves.