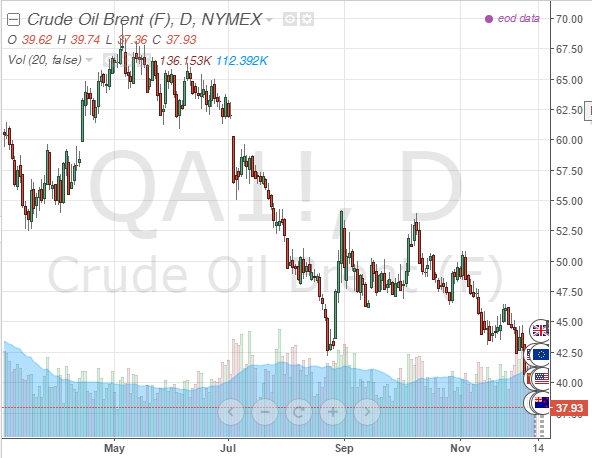

Low oil prices are expected to dominate the market in 2016, which is why Russia is going to practice austerity. This is what Russia’s finance minister Anton Siluanov said during during a press conference in Kazan. To be more specific, the minister doesn’t deny $30/b and below at some point in 2016. At the same time, we should keep in mind that the IMF have already downgraded its global economic forecast 4 times this year, which is a wakeup call indicating the likelihood of lower oil demand next year. The minister is almost sure that under such circumstance where Iran is about to come back to the global market with 1-1,5 million barrels a day and given today’s excessive oil inventories, we are likely to see the bearish bias dominating the market in 2016.

OPEC’s lack of consistent policies is another major factor leading to lower oil prices in the near-future. This leads OPEC to the point when ach and every OPEC member has to fight for its own market share by itself. Given the big picture in the oil market, Russia as an economy heavily dependent on oil export will have to cut its budget in order to let the economy sustain it, the minister says.

At the same time, Russia’ central bank announced the stress scenario, which implies $35/b. If this scenario does manifest itself, the Russian GDP will shrink by 2-3% in 2016, while brining the rate of inflation up to 7%, with a further upward pressure on it. Under inflation growth, the central bank will be forced to get down to tougher money-and-credit policies.

At the same time, the Russian Ministry of Finance predicts higher oil prices over the long term. In particular, the prediction implies that oil prices are likely to move within the range between $40/b and $60/b over the next 7 years. At the same time, the experts say that Russia has already adapted to $40/b, which is why there is no point in expecting $100/b.