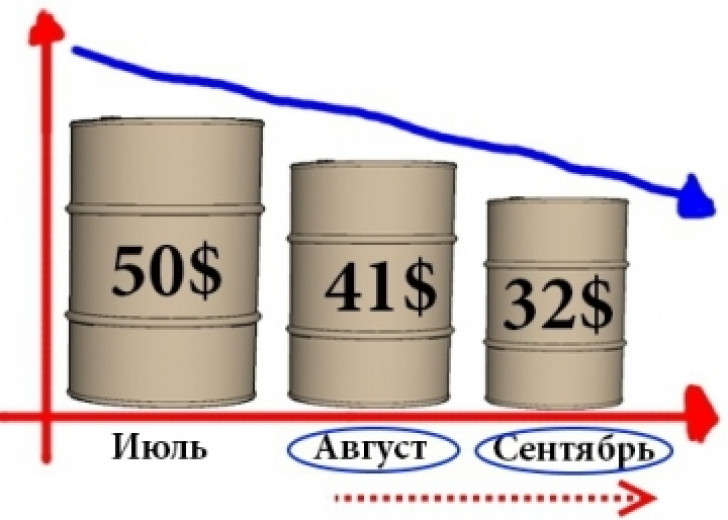

Crude oil keeps on going down in value. At this point, both WTI and Brent prices have been going down for 3 months in a row. As stated in the previous forecast, crude oil reached $50/b in July, which was followed by a market plunge all the way down to $41/b.

At this point, all of us are wondering what are the reasons behind such a crash. Well, there are several fundamental and technical reasons for that, Masterforex-V Academy experts say.

Analyzing the Fundamental Reasons for the Biggest Oil Price Crash since 2008

Masterforex-V Academy suggests considering the following factors:

Huge oversupply. The thing is that China and the Eurozone, which are the world’s biggest consumers of crude oil, are currently suffering from multiple economic and financial problems, which leads to reduced consumption of crude oil and lower demand fro it. The Greek crisis is coupled with a weak Euro, the Chinese stock market crashed and then followed the devaluation of the Chinese Yuan amid an economic slowdown in China.

Shanghai Composite has been going down for 4 months in a row despite the steps taken by the Chinese government to cap this crash.

At the same time, Iran is now free from Western sanction and is about to go back to the global market as a major exporter of crude oil, which is also increasing the oversupply.

Shale oil boom. The promised bankruptcy of shale oil companies amid ultra-low oil prices is not happening. The thing is that they keep on finding new ways of producing even cheaper shale oil. This factor also affects the market to a great extent.

New technologies. Arthur Clark once made a brave prediction that by 2016 all the currencies in the world would be ousted by an equivalent - kilowatt per hour. At this point, the prediction is not that illusive.

These days, we see more and more attempts to invent and use vehicles that o not demand coal or oil. Electro cars are getting more and more popular. In the future, this tendency may reduce the consumption of crude oil worldwide.

Green energy. The world’s demand in energy is growing at an unprecedented rate. Therefore, more and more experts share the same opinion that the future belongs to the so-called “green” energy carriers, i.e. those energy sources that do not demand burning fossil fuels.

They use more of wind and solar energy, simultaneously developing geothermal energy. Nuclear energy is still popular despite all the dangers. If put together, there energy sources are said to be able to cover the humanity’s energy needs for decades to come.

Analyzing the Technical Reasons for the Oil Crash

For of all, it all started with overpriced oil. Before crashing, crude oil cost over $100/b.

At the same time, other experts say that the bullish cycle was over and it was followed by a bearish cycle, which is still underway more than 12 month later.

There is a point of view that commodity prices are subject to cycles. However, the length of bullish and bearish cycles varies from expert to expert. As to my own opinion, the bullish commodity cycle ended in 2012. This is the time when Tesla Motors came up with Tesla Model S. This is hardly a coincidence.

This is the time when a new major bearish cycle started and it has been there ever since. For now, it is hard to say how long this cycle is going to last. At this point, if we use Google Trends

To take a look at the “oil price” request, we are going to see the highest figures in 90 days.

Therefore, technically speaking, we are likely to see consolidation around the current levels in short-term perspective.

As for mid-term and long-term perspective, there are 2 most probable scenarios.

1. A further drop down to $30/b and below followed by a prolonged sideways market within the scope of the $20-$40 price range. If this is he case, this flat market is going to last from several months to several years. We could see a similar cycle in 1986, when oil depreciate from $35/b down to $10/b. If to just those figures to inflation, this is the same as seeing oil dropping from $100/b down to around $20. At that time, the price stood still for several years, apparently causing a lot of financial losses to oil exporters. Even today some experts believe that this is one of the key reasons why the USSR finally ceased to exist.

2. A drop down to $30/b followed by a sky-rocket move to $100-$170/b. After that, we are going to see another market crash down to $20/b. This time this is going to be the final crash and the price of crude oil will not be able to recover from it anymore. If this is he case, this is going to be the end of the oil era…