OPEC doesn’t deny the possibility of holding another emergency summit in the near future. At this point, OPEC members are reported to be discussing the issue. According to Masterforex-V Academy the major reason why OPEC is planning the summit is the fact that oil prices resumed its downtrend while experiencing downward pressure coming from the increasing oversupply of crude oil in the global market.

It should be noted that the next planned OPEC summit is scheduled for December 4th, 2015. It is going to take place in the capital of Austria. Still, at this point, it seems like OPEC cannot do without holding another summit in the near future since the current situation in the global market of crude oil requires it.

In the meantime, OPEC experts say that the current market plunge has been caused by excessive supply coupled with decreasing demand from China and other major oil consumers. Apparently, the agreement on the Iranian nuclear program reopened the doors to the global market of crude oil for Iran, which is going to result in even higher oversupply and stronger pressure on oil prices.

It should also be noted that on July 5th, OPEC decided to abstain from cutting its oil production once again and leave the daily oil production volume at 30 million barrels a day. This decision was made in order to defend the cartel’s market share amid the growing supply of shale oil coming from the USA.

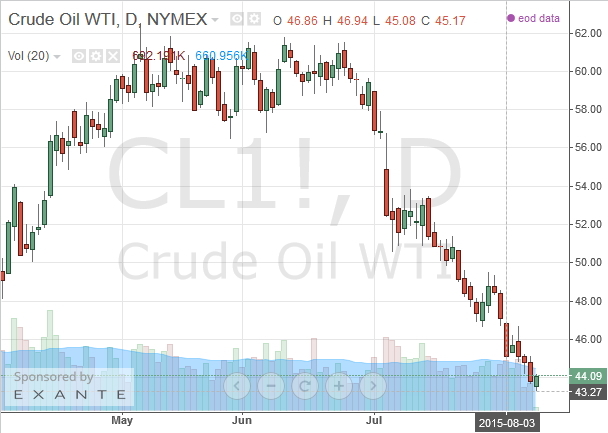

At the same time, Masterforex-V Academy reports that oil prices have already dropped by 25% since this year’s high. The bias is clearly bearish.

Brent oil futures for September delivery on ICE Futures depreciated down to $48,43 per barrel earlier today. This was a $0,18 or 0,37% drop.

WTI oil futures for September delivery on NYMEX depreciated down to $43,73 per barrel earlier today. This was a $0,14 or 0,32% drop.

Therefore, more experts say that Saudi Arabia’s strategy has failed so far. They say that the failure is that the country decided to fight against U.S. shale oil producers instead of gradually abandoning supporting oil prices by cutting down on its oil production volume.