Since the start today’s trading session, crude oil prices has been going down since the market participants are afraid that Iran is going to come back the the market as a major oil exporter after years of sanctions imposed by the West over the Iranian nuclear program.

In particular, the trading week started as follows:

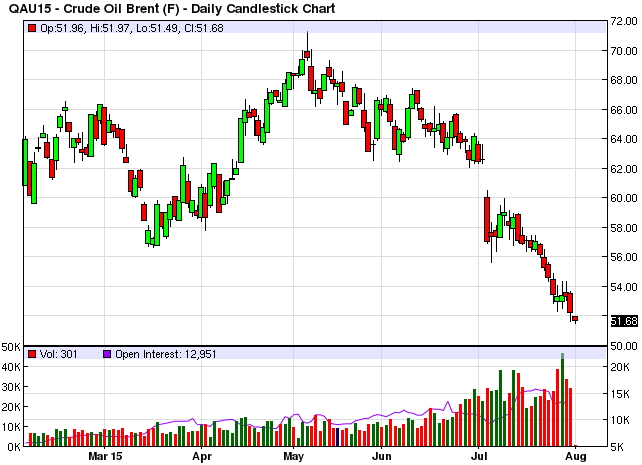

- The Brent oil futures for September delivery lost 0.48% and depreciated down to $51,96 per barrel.

- The WTI oil futures for September delivery lost 0.49% and depreciated down to $46,89 per barrel.

According to the IRNA, Iran may well increase its oil production by 500 000 barrels a day. This may happen within a week after the sanctions are completely canceled. Moreover, the next production increase may happen within 4 weeks after that. IF this is the case, the production is going to be increased by 1 million barrels. Last week, Iran produced some 2,85 million barrels a day as opposed to 3,6 million barrels a day as of late 2011.

Apparently, if this happens, oil prices are definitely going to face severe downward pressure. The situation is aggravated by the new coming from China – the world’s biggest consumer of crude oil.

The thing is that not so long ago, Markit Economics and Caixin Media Company have recently released the final results of their Chinese PMI research for July. The truth is that the July figures came out to be worse than expected as well as the previous figures - 47,8 points in July against 49,4 points in June.

It turns out that July was the worst month of the year for crude oil. Both Brent and WTI oil saw the biggest monthly price drop in 2015. The last week of the month was especially bearish. All in all, Brent and WTI oil lost in price 18% and 21% respectively in July. The latest report from Baker Hughes regarding an increase in the amount of oil rigs in the USA was one of the key bearish drivers of the past week.