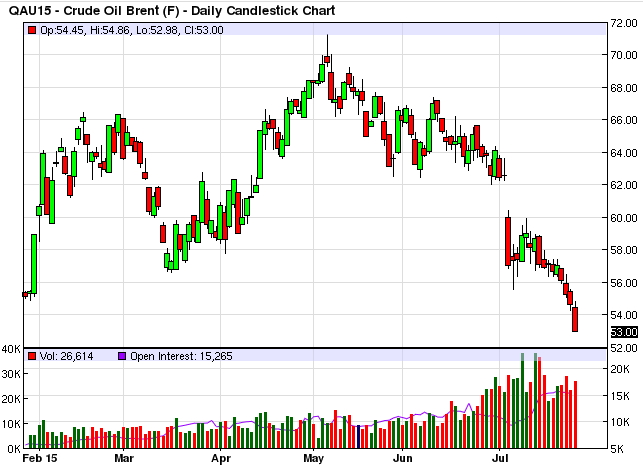

The cost of September future contract of Brent oil has dropped to 53.71 US dollars during London trading session this Monday. This is 1.69 percent lower than the cost of the previous trading session held on Sunday. That day the price of Brent during a trading session amounted to 54.67 dollars.

The last time oil of this brand dropped below 54 dollars per barrel was on March 20. This is proved by data recorded at the stock exchange. That day barrel of Brent has reached the minimal point of 53.55 dollars.

Cheap oil has had negative influence on Russian national currency. On Monday ruble showed the strongest decline since this March. At 14:54 Moscow time 1 dollar was traded for 59 rubles. Today European currency has updated its maximal point since March 16, having stepped over the point of 66 rubles. At 14:54 Moscow time Euro stopped at the level of 65.8 rubles, as highlighted by analysts of Hantec Markets broker company.

Last week Morgan Stanley made public a forecast, which states that previous drop of oil prices, as well as reduction of investment in oil recovery following by it have not yet led to smaller supply of “black gold” into the world market. Besides, the report highlights that during the last six months the volume of oil recovery in OPEC countries has increase by about 1.5 million barrels per day. Taking this into consideration, experts of Morgan Stanley have concluded that the world is to face the strongest in the last thirty years drop of oil prices. If sanctions are removed from Iran, and the situation improves in practically struck by civil war Libya, then the inflow of new oil to the world market can interfere with growth of quotations. At such turn of events, according to experts, the decline will run over at least 3 years.

Oil Companies Freeze New Projects

The largest oil companies have frozen new projects to the sum of 200 billion dollars due to drop of oil prices. This has been written about by the “Financial Times”, referring to the data received by Wood Mackenzie consulting company in the course of its research. According to Wood Mackenzie, companies that have frozen new projects include the following: Norwegian Statoil, British BP, Australian Woodside Petroleum, English-Holland Royal Dutch Shell, and based in the US Chevron.

Over one half of projects connected with recovery of “black gold” at great depth are mostly concentrated around the Western coast of Africa and the Gulf of Mexico. Technical requirements to recovery of raw materials in such conditions, as well as inflation have made these projects much more expensive. “Work of drilling units at great depth is worth hundreds of thousands dollars per day,” highlights the FT.

According to experts, this is the company’s way to protect dividends of its investors. The edition highlights that drop of oil prices, accompanied by decline at the market of gold, copper, and other raw materials, is pushing raw material index Bloomberg to a six-year minimum. What is more, this is happenning at the time of weak economic growth in China and rising supply in all branches.

Drop of oil prices since last summer has lead to delay of 46 large gas and oil projects with the volume of reserves amounting to 20 billion barrels of oil equivalent. The edition admits that this is more than all proved reserves of Mexico.

“This May Rystad Energy consulting company has made public a research, according to which oil project to the sum of 118 billion dollars will be suspended, but new data prove that the sum is much higher,” highlights the “Financial Times”.

Kremlin Asks to Withhold Comments on Oil Price

Kremlin and economic institutions of Russia follow the dynamics of oil prices and do not find it reasonable to draw any conclusions on the basis of short-term data. This has been stated by Dmitry Peskov, spokesman of the President of Russia.

“Kremlin, as well as all Russian institutions connected with economy, keep a close eye on dynamics of oil prices,” said Peskov. He has reminded that experts are making very different predictions – “from steady growth to most apocalyptic predictions”. “At this point it is difficult to say which predictions will prove true. Only one point is clear; it is the fact that volatility and fluctuations of these prices during one week cannot serve the basis for a more lasting perspective, for example, a quarter,” supposes Putin’s spokesman. “Nobody makes snap judgements every week or every month, for we see that dynamics is rather unsteady and sometimes multidirectional,” admitted Peskov, adding that oil prices have also had “upswings”.

At this point oil market has almost entered a “bearish” zone: price drop for the last six weeks has exceeded 20 percent. By the end of the week Brent oil has shown decline below 55 dollars per barrel.

Predictions about lasting small demand and surplus reserves in the United States, as well as plans of Iran to increase supplying “black gold” regardless the price speak for the benefit of rather high likelihood of further drop of the world's oil prices. TTus, according to Bloomberg agency, Amirhossein Zamaninia, Deputy Minister of Petroleum of Iran, has expressed an opinion within a year since sanctions are removed, oil market will get 1 million barrels per day.