According to the recent report made by the U.S. Energy Information Administration (EIA), the USA is expected to outpace the Russian Federation in terms of crude oil production by the ned of this decade.

Market Leader and Masterforex-V academy offer you to take a closer look at the situation. It appears so that the United States is expected to oust Russia from the world’s leading oil-producing nation. In particular, the expected average daily volume of oil production in the USA is expected to hit 11,58 million barrels while the same forecast for Russia is only 10,15 million barrels a day.

Still, the same experts predict that by 2035 the two oil-producing giants are going to change places once again. Russia is expected to boost its oil production up to 10,85 million barrels a day on average while the USA’s figures are expected to go down to 10,35 million barrels a day on average.

It is necessary to remind you that the USA is currently the world’s 3rd biggest oil producer after Russia and Saudi Arabia. Last year, the U.S. oil production volume increased by 1,2 million barrels up to the all-time high (since 1900) of 8,7 million barrels a day. The similar data for Saudi Arabia and Russia are 9,7 and 10 million barrels a day.

It is necessary to remind you that the USA is currently the world’s 3rd biggest oil producer after Russia and Saudi Arabia. Last year, the U.S. oil production volume increased by 1,2 million barrels up to the all-time high (since 1900) of 8,7 million barrels a day. The similar data for Saudi Arabia and Russia are 9,7 and 10 million barrels a day.

It is necessary to underline that the EIA is an independent statistics agency under the U.S. Department of Energy, which constantly makes long-term predictions on global and U.S. oil production. For instance, the latest predictions embrace the long-term period up to 2040.

Such forecasts consist of two scenarios: the basic one and the alternative one (high/low economic growth as well as high/low oil prices).

At the same time, the experts predict that the USA’s oil export and import will match by 2028. It is interesting to note that the USA has been the net importer of crude oil since 1950. At the same time, the experts do not deny the scenario when the United States may stop being dependent on the import of crude oil even sooner - until the end of this decade.

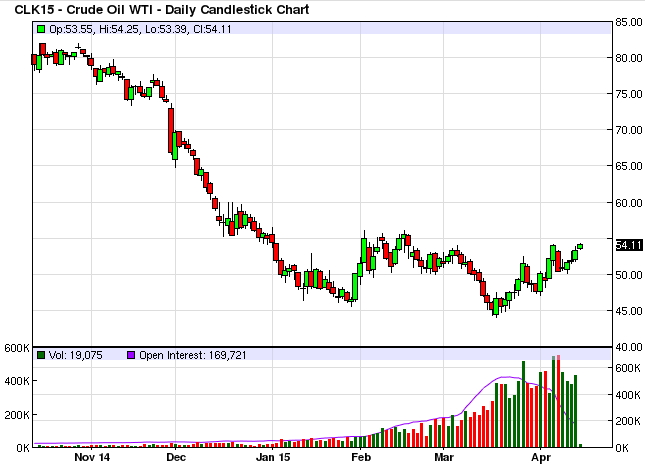

At the same time, the agency downgraded its oil price forecast as opposed to the previous one. The basic forecast for Brent is $56/b in 2015, $79/b in 2020 and $91/b in 2025.

The comments to the basic forecast say that the downward pressure exerted by the oversupply in the global oil market is going to keep Brent oil prices below $80 up until the year of 2020. Later on, the U.S. oil production is expected to shrink. Still, the higher production in other countries won’t let the price break above $100/b.