According to the EIA, the U.S. shale oil production is expected to grow by as little as 1000 barrels a day, which is almost nothing if to compare the industry’s scale. With that said, this prediction is almost identical to the absence of production growth in the sector of American shale oil.

The prediction came as a part of the EIA’s report published on March 9th, Market Leader reports. At the same time, the experts of Masterforex-V Academy report that if the prediction manifests itself, this is going to be the lowest production growth rate since 2011. As for the reasons why the agency made such a prediction regarding the near-term future of the domestic shale oil industry, they have a lot to do with the analysis of the current state of affairs in the USA’s 7 major shale oilfields. These oilfields account for 95% of the production growth seen in 2011-2013. All of those oilfields are expected to see a production slowdown.

it is not accidental that the American shale oil industry is cutting down on production. the thing is that shale oil production is rather costly as opposed to conventional ways of producing crude oil. If to consider the fact, that crude oil has been losing its value since mid 2014, shell oil producers are now having a hard time making money with their businesses, not to mention the fact that most of them are unprofitable now. The so-called shale oil revolution broke out in 2008, thereby allowing the USA to consolidate its position in the global oil arena. Still, the entire global oil industry is now in depression with ultra low prices hitting the financial performance of oil companies worldwide. More and more experts keep on coming up with doomsday scenarios of the shale oil industry. Still, if to go deeper into the matter, we can see that everything is not that clear about the fate of the industry. Some experts still believe that it is going to survive the shock.

The thing is that shale oil producers faced a similar problem in 2008 when crude oil peaked at $146/b only to see a sharp collapse down to $31/b. This was the time when the sale boom was just making its fears steps along with quickly recovering oil prices. In 2011-2013, the average price of a barrel of Brent crude oil was above $100. This was the most stable period in the market since the 1970s. Apparently, high oil prices favored the sale boom. Still, the area of high oil prices is now questioned at best.

Goldman Sachs, one of the major players in the commodity market, downgraded its oil forecast by $25-35/b. According to the forecast, the average price of Brent oil in 2015 and 2016 is going to be $50,4/b and $70/b respectively. The similar figures for WTI oil are $47,1/b and $65,3/b respectively.

Deutsche Bank and Societe Generale are more optimistic on the near-term fate of crude oil: Brent - $55/b (Societe Generale) and $59,35/b (Deutsche Bank).

According to Goldman Sachs, low oil prices may even bring positive changes to the industry through making it more immune to price fluctuations. As for the gloomy forecasts, they assume that in order to suspend the production of shale oil in the USA, WTI needs to be priced around $40/b for the next 6 months. However, the price is expected to find the bottom in Q2 0215 and recover at least to $65-79/b by early 2016.

According to the EIA’s latest report, the average daily production was 9,2 million barrels in December. This year, the figures are expected to increase up to 9,35 million barrels a day.

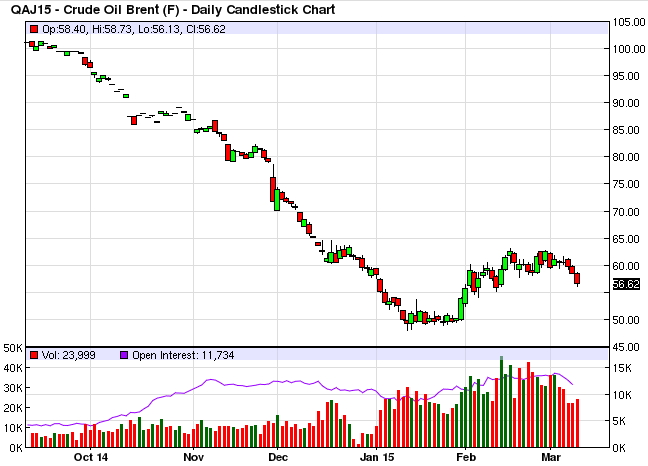

Meanwhile, crude oil is going down in value again, which is confirmed by he chart below, courtesy of Masterforex-V Academy.

Shale Optimism

The experts assume that the current period of low prices may give birth to a new industry, with reduced production costs and higher productivity. The thing is that the current state of affairs in the global market of crude oil will eventually push the producers to abandon the costliest deep-water projects along with the projects related to oil sands.

With that said, the companies will have to cut their spending by 20-25%, with most small and mid-size players expecting takeovers. In other words, the industry is facing a period of consolidation. Big-scale players are going to get rid of unprofitable assets and focus on more promising projects. Eventually this is going to end up with a reinforced industry.