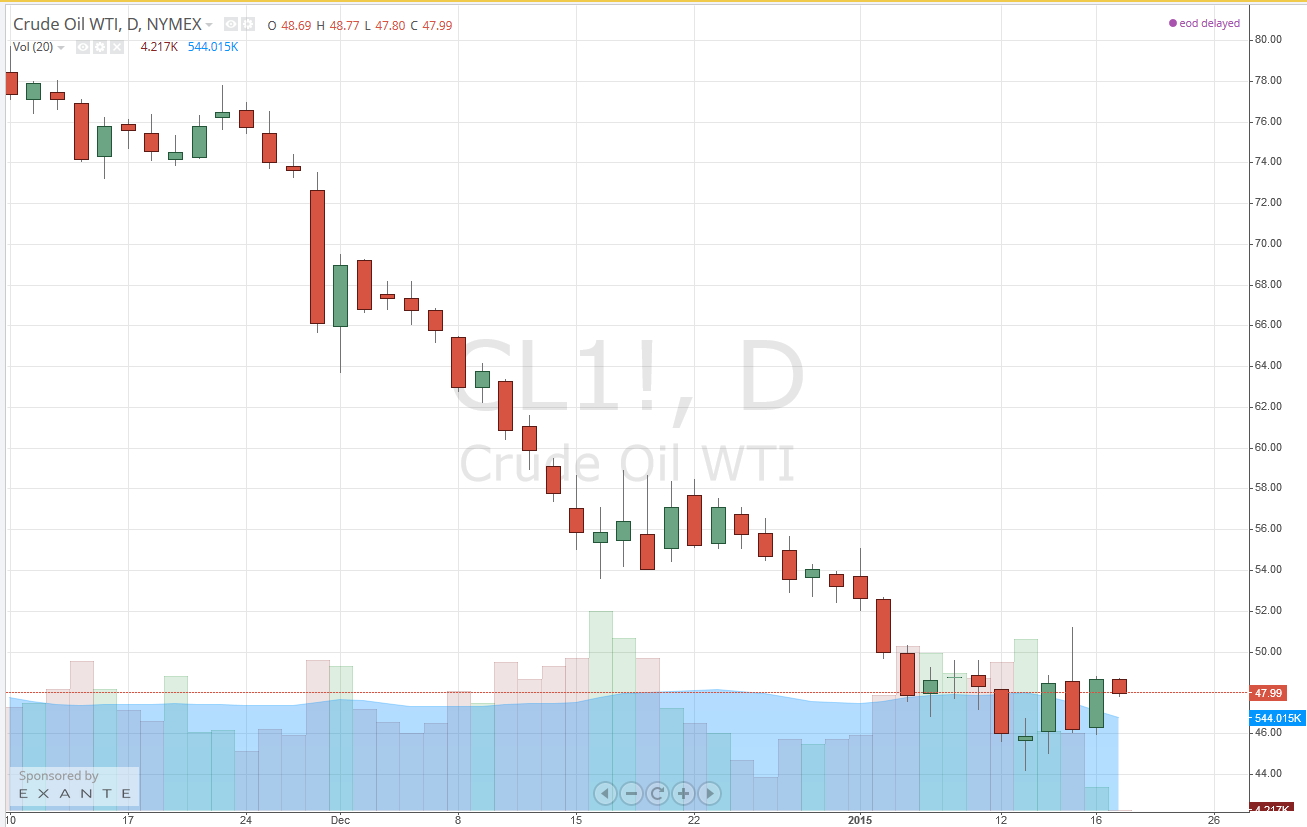

Oil price seem to never stop going down since mid 2014. Yesterday, the prices went down a little bit as well. The thing is that the market seems to be reacting this way to the expectations of poor economic stats ,which are about to be released in China, the world’s biggest consumer of crude oil.

It appears that crude oil resumed its bear market on Monday after closing higher last week fro the first time in several months, Masterforex-V Academy reports.

In particular, the Brent oil futures for March delivery traded on ICE Futures dropped by $0.37 per barrel (0,74%) down to $49,8/b. The WTI oil futures for February delivery traded on NYMEX dropped by $0.36 per barrel (0,74%) down to $48,33/b.

At the same time, the cost of new residential property in China declined by 4,3% in 68 out of 70 biggest Chinese cities. On Wednesday, January 20th, China is going to report on its GDP in Q4 2014. Most experts assume that the Chinese GDP is going to slow down to 7,2%. The thing is that last year, the GDP failed to come up to the government’s expectations (7.5%) and showed the lowest growth rate in 24 years! Yet, there is no reason to expect any changes in the negative tendency.

Meanwhile, Iran asks Saudi Arabia to suspend the collapse of oil prices by cutting down on its oil production and therefore reducing the expanding oversupply in the global market of crude oil. So far, there has been no official response coming from Saudi Arabia. The only thing we know for sure is that Saudi Arabia is currently determined to produce oil at the same level no matter what…