On November 29th, Bitcoin beat another threshold. This time, the world’s largest cryptocurrency exceeded the $10K threshold and set another all-time high at 11377 USD/BTC, only to crash by 20% at a time down to 9290 USD/BTC, Coindesk reports. All of that happened within a couple of hours.

It's also interesting to note that after beating 10000 USD/BTC, it took Bitcoin just 24 hours to bet another psychological level, which is 11000 USD/BTC. A couple of hours after peaking at 11377 USD/BTC (this is a new all-time high), Bitcoin crashed down to 9290 USD/BTC. Later on, the cryptocurrency did actually manage to win back some of the lost ground and go above 10000 USD/BTC, NordFX reports.

In 2017 alone, BItcoin has already gained 1000%, the entire cryptocurrency market has gained 1700%. Thetotalmarketcapisnow $334 billion!

So, Bitcoin has recently shown the trait that has been scaring away many of those big-scale investors. Specifically, we are talking about volatility. Indeed, cryptocurrencies in general and Bitcoin in particular have always been rather volatile, with a constant roller-coaster thing.

However, Jeff Curry, global head of commodity research for Goldman Sachs, thinks that is a natural process for relatively young assets. Today’s Bitcoin market cap is $160-170 billion. On the one hand, that’s quite a lot. But on the other hand, these figures cannot be compared even close to the ones of gold. The gold market cap is $8300 bn. The point is, gold has been a reliable investment asset for centuries while digital currencies are babies with a couple of years of history. If digital currencies survive and last for decades, they may see their market cap boost and their volatility decline.

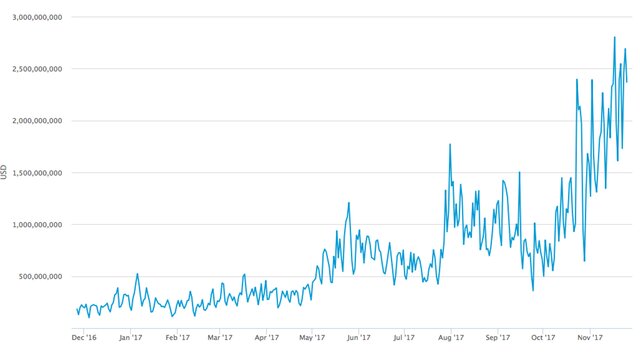

At the same time, The Wall Street Journal reports that NASDAQ is planning to launch Bitcoin futures in the first part of 2018. Cantor Fitzgerald is also planning to launch their BTC derivatives. They say, Bitcoin derivatives would be a huge step to making digital currencies more mature. By the way, the BTC transaction volume has already exceeded 2 billion dollars a day.